Get the Company Revenue Rankings on a PDF suitable for printing

For detailed metrics on each company, including profits and market caps, download the Lonergan SV150 Datatable

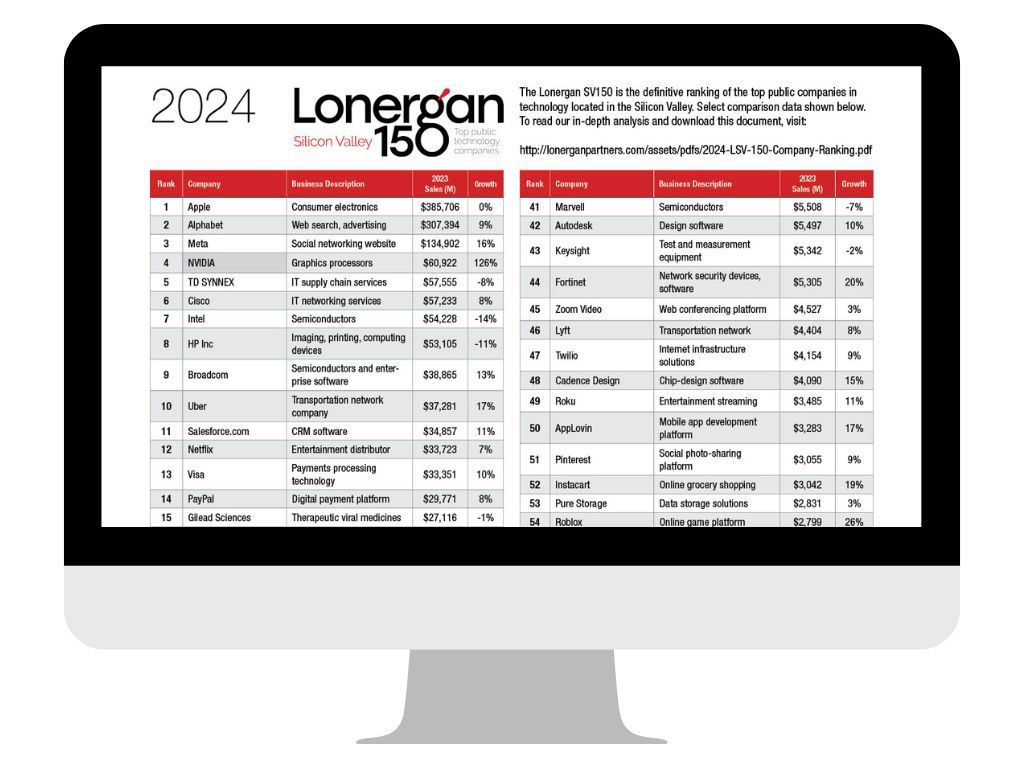

The Lonergan SV150 is the definitive ranking of the top public companies in technology located in the Silicon Valley.

Silicon Valley weathered the 2023 storm, riding a wave of investor enthusiasm for generative AI technology to massive market cap gains in the ranks of the SV150, despite reporting only modest growth in revenue. Net income also grew at a record rate, reflecting efficiency gains from 2022 – 2023 efforts to plump up margins — including significant labor force reductions at many LSV 150 firms.

Read on for Lonergan Partners’ in-depth insights and analysis of the company performance changes impacting the top 150 public companies in technology in the Silicon Valley.

Silicon Valley public tech companies enjoy a surge in investor confidence

April 17, 2024 Once again, Silicon Valley pulled a rabbit out of the hat and defied widespread predictions for a disappointing 2023. And despite US-inflation based anxiety returning in recent days, investors seem to be cautiously optimistic that the tech sector will perform well in 2024.

Here are the latest results for the 2023 LSV 150:

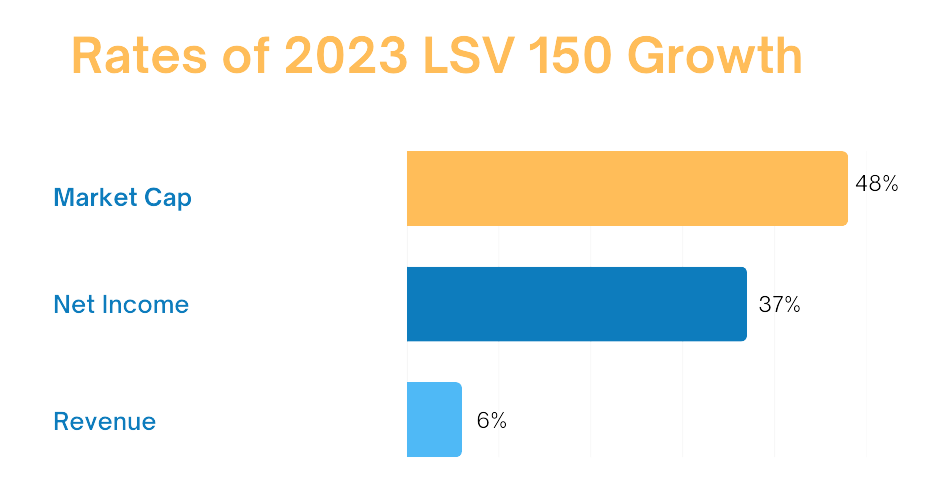

2023 Revenues: same company sales were up 6%, to $1.76 Trillion - a new record high - with 2023 inflation running at 3.4% according to the Department of Labor. Most of the LSV150 ranked companies (93 out of 150, or 62%) grew sales faster than the rate of inflation.

2023 Net income: the rankings saw net income grow 28% from last year's list, to $343 Billion. Positive 2023 net income was reported at 69 companies.

March 2024 Market cap: up a staggering 48% from March 31 of last year, to $13.7 Trillion. This rate of growth exceeded the gains of the S&P 500 Index (27.4%) and the NASDAQ composite (34%) for the same time period.

The Trillion dollar market cap club expands

As of the end of Q1 2024, the largest four companies of the LSV150 were all valued at over $1 Trillion in market capitalization - after NVIDIA achieved this distinction for the first time back in June 2023.

The current top market cap rankings for April 17, 2024 are:

- Apple (LSV #1) market cap = $2.6 Trillion

- NVIDIA (LSV #4) market cap = $2.1 Trillion

- Alphabet (LSV #2) market cap = $1.9 Trillion

- Meta (LSV #3) market cap = $1.2 Trillion

Note: the two other members of the $1 Trillion public company market cap club are Seattle based Amazon ($1.9 Trillion) and Microsoft ($3.1 Trillion) - currently the most valuable public company in the world .

The Silicon Valley 150 boasts 38 companies included in the S&P 500 – an all time high

With the recent addition of Super Micro Computer (LSV #26), the ranks of the Lonergan SV150 now include 38 of the companies selected for the S&P 500 - an all time high. S&P 500 companies must meet a rigorous standard, not just for size but for other criteria such as liquidity and profitability as well - before they are approved by the S&P 500 selection committee. Having an increasing number of LSV 150 companies merit inclusion in this prestigious index reflects the maturity and clout of publicly traded Silicon Valley tech.

As a point of reference, in 2015 only 21 of the LSV150 companies were included in the S&P 500.

The Apple factor

The metrics of the LSV150 are always greatly impacted by what's going on at #1 ranked Apple (representing 22% of the revenue of the current Lonergan SV150). In 2023, Apple's overall financials remained fairly static, with the exception of slight increase in profitability. Here are Apple's year-over results:

Revenues: down 0.48%, from $387,573 Million to $385,706 Million.

Net Income: up 6.03% from $95,171 Million to $100,913 Million

Market Cap: down 0.49% from 2,661 Trillion to $2,648 Trillion

Without Apple's drag on growth, the Lonergan SV150 would have increased revenues by 8%.

Lonergan SV150 aggregate market cap reaches a new record high

Fueled by investor enthusiasm for the AI story, LSV 150 aggregate market cap broke $13 Trillion for the first time. Stock price winners (88 companies growing market cap by 77.8%) convincingly outdistanced stock price losers (60 companies with market cap losses of ‑3.8%), with gainers creating a huge market cap bump of $4.55 Trillion, as opposed to losers creating a less dramatic market cap dip of $130 Billion.

In the world of Silicon Valley tech, size does continue to matter. Market cap growth in the LSV 150 was heavily weighted towards larger companies. In the table below, the one year change in market cap is broken out for the companies in the Top 50, the Mid 50 and the Bottom 50 — and the Bottom 50 shows a slight decrease in aggregate market cap.

The following table breaks down the changes in market cap by category:

Category | 2024 Lonergan SV 150 | Market Cap | One Year |

|---|---|---|---|

Total SV 150* | $13.7 T | $9.3 T | 47.8% |

NASDAQ Composite | 16,379.46 | 12,221.91 | 34.0% |

Top 50 Ranked Co’s | $13,129 B | $8,769 B | 49.7% |

Mid 50 Ranked Co’s | $422 B | $357 B | 18.2% |

Bottom 50 Ranked Co’s | $119 B | $126 B | -5.6% |

Top Gainer — Super Micro (LSV #26) | $59,138 M | $5,875 M | 907% |

Top Loser — Cutera | $29 M | $463 M | -94% |

All 88 Gainers | $10.4 T | $5.8 T | 77.8% |

All 60 Losers | $3.3 T | $3.4 T | -3.8% |

*Note: Table reflects year-over-year market cap changes at 148 ranked companies; two companies are recent IPOs and were not public at the end of Q1 2023.

Where are all the tech IPOs?

2023 in Silicon Valley reflected the overall US economy with an almost complete pause in IPO activity. In fact, only two tech IPOs from the past twelve months made it onto our listing; Instacart (LSV #52) and Reddit (LSV #93), shown in the table below.

2024 may see a big uptick in tech IPO activity. Palo Alto based Rubrik (with over $600 million in 2023 revenue) has already filed an S‑1, and the list of other companies expected to file in 2024 has many potential future LSV150 names on it, including San Francisco companies Stripe and Databricks.

| Rank | Company (year public- IPO unless noted) | Business Description | 2023 Sales ($ million) | Growth | Profitability | Mkt Cap (March 28, 2024) |

|---|---|---|---|---|---|---|

52 | Instacart (2023) | Online grocery shopping | $3,042 | 19% | -53% | $9.9 b |

93 | Reddit (2024) | Online forum for user generated content | $804 | 21% | -11% | $7.8 b |

Twelve Months of Back to Basics

With capital more expensive and a scarcity of willing acquirers, companies in the Lonergan SV 150 went back to basics in 2023. Some companies pruned uncertain long term investments, and any company with an AI story shifted resources in that direction. Management changes were numerous: we tracked CEO and C-Suite personnel changes, with founder CEOs stepping down in larger numbers than usual (read our CEO turnover report and follow up analysis on C-Suite changes). Layoffs also continued, but at a slower pace than at the end of 2022 and start of 2023.

Slowdown in acquisitions

M&A markets were sluggish in 2023. Only five Lonergan SV150 ranked public companies were fully acquired since our ranking last year and most deals were already in the works at the time of the last ranking. These finished deals include:

- (2023 LSV #23) VMware acquired by Broadcom (LSV #9)

- (2023 LSV #48) Splunk acquired by Cisco (LSV #6 )

- (2023 LSV #89) New Relic acquired by TPG/Francisco Partners

- (2023 LSV #121) Momentive (Survey Monkey) was acquired by Symphony

- (2023 LSV #141) Sumo Logic acquired by Francisco Partners

As of this posting in April 2024, there are two additional LSV150 ranked companies in the process of being acquired, including HPE's intention to acquire LSV #40 Juniper, and J&J's bid to acquire LSV #98 Shockwave Medical.

Note: at this time last year. there were ten companies coming off the prior year's ranking after being fully acquired.

Struggling companies run out of options

2023 saw the highest number of US corporate bankruptcies since 2010 - according to S&P Global Market Intelligence, 2023 was even worse than the peak business shock of the Covid-19 pandemic, with 642 bankruptcy filings in 2023 versus 639 in 2020.

Normally very few LSV150 companies leave the list due to delisting or bankruptcy, but this past year two Lonergan SV150 ranked public companies have been in Chapter 11. These include:

- (2023 LSV #100) Shift filed for Chapter 11 on October 9, 2023

- (2023 LSV #117) Invitae filed for Chapter 11 in February 2024

2024 Surprises Ahead?

In an economy which started out in Q1 2023 rehearsing a woeful tale of layoffs and sluggish stock performance, the past twelve months in the LSV 150 actually ended up telling what seems more like a Horatio Alger-style story of burgeoning prosperity.

We at Lonergan Partners can’t wait to see what unexpected tech stories the next 12 months in the Silicon Valley will bring.

We will be sharing additional analysis on the People and Companies of the LSV 150 in the weeks to come.

Follow us on LinkedIn:

Click here for Footnotes, prior year archived LSV150 Rankings, and Media Assets.