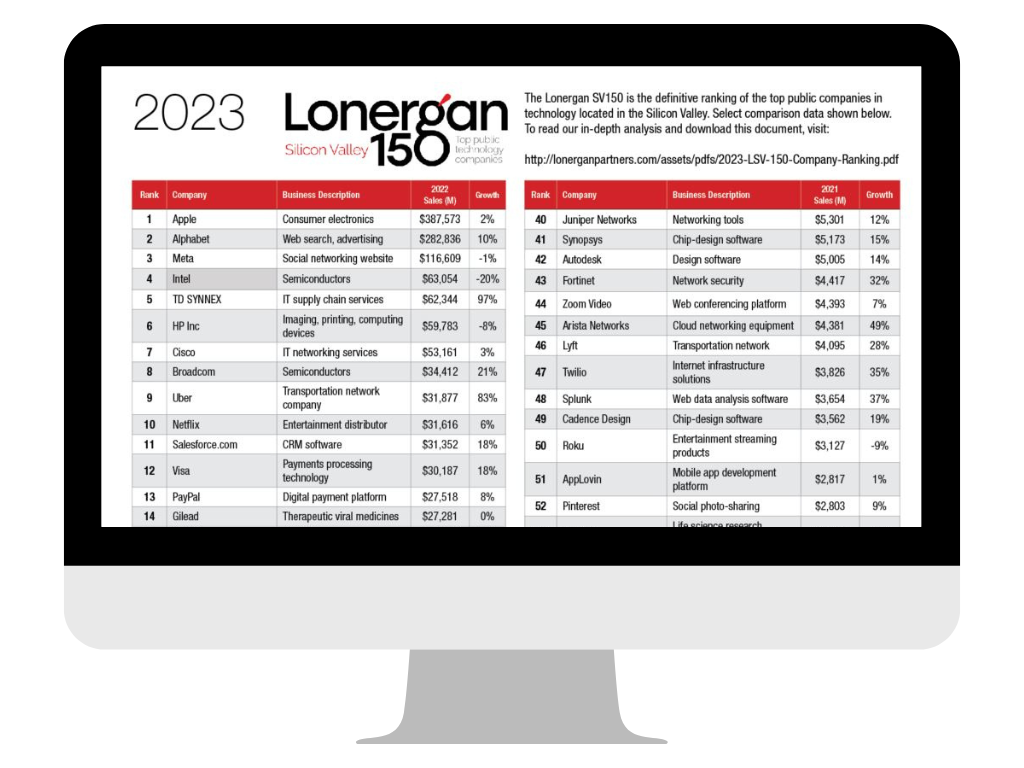

Get the Company Rankings on a PDF suitable for printing

For detailed metrics on each company, download the Lonergan SV150 Datatable

Read our People Insights

The Lonergan SV150 is the definitive ranking of the top public companies in technology located in the Silicon Valley.

Only in Silicon Valley could a sector with record high revenues, sales growth higher than inflation, and close to $250 billion in net income be judged a “troubled industry.”

With Spring coming and the Silicon Valley Bank deposit crisis behind us, many in Silicon Valley are hoping the tech sector is living through the “pain” before the “gain.” Layoffs have been announced at over 50 of the companies in the rankings, and companies are pruning less promising investments and lining up behind the banner of “efficiency.”

Adaptation is the theme for 2023 in the Silicon Valley, and the companies behind the tech tools needed to compete globally are working to get their own houses in order.

Read on for Lonergan Partners insights and analysis of the company performance changes (below) and people leadership trends impacting the top 150 public companies in technology in the Silicon Valley.

The “Big Story” — Silicon Valley public tech companies adapt to the post pandemic economy

2022 results in the Lonergan Silicon Valley 150 offered up modest growth alongside lower profits in a shifting world economy:

Revenues: up 8.5% from last year’s ranking, to $1.67 Trillion - a new record high — with 2022 inflation running 6.5% according to the Department of Labor. Most of the LSV150 ranked countries (116 out of 150, or 77%) grew sales faster than the rate of inflation.

Net income: the rankings saw net income drop 28% from last year’s rankings, to $246 Billion - well off the record high of $342 Billion set in 2021, but still showing a substantial increase from 2020 (historical metrics not adjusted for inflation). Positive 2022 net income was reported at 69 companies, about the same number as were profitable in 2021.

Market cap: down 11.9% from March 31 of last year, to $9.3 Trillion, after six consecutive years of the rankings showing market cap gains.

Apple creates a drag on growth

#1 ranked Apple (representing 23% of Lonergan SV150 total revenue) grew calendar year 2022 revenues by only 2% (after reporting 29% growth for the 2021 calendar year). Without Apple’s drag on growth, the Lonergan SV150 increased revenues by 10.4%.

Note: the Apple fiscal year ended September 30, 2022; Apple fiscal year results adjusted to calendar year per our ranking methodology.

Surprise! 1 in 4 Lonergan SV150 companies show higher market caps year-over-year

Tech sector support has improved since the last half of 2022, with almost 1 in 4 companies now in positive year-over-year market cap territory, as opposed to only 1 in 10 back in September, 2022.

Aggregate market cap for the Lonergan SV150 as of March 31, 2023 was down 11.9% year-over-year, compared to the tech heavy NASDAQ composite which was down 15.4%.

Let’s look at the changes in market cap by category:

Category | 2023 Lonergan SV 150 | Market Cap | One Year |

|---|---|---|---|

Total SV 150 | $9.3 T | $10.5 T | -11.9% |

NASDAQ Composite | 12,221.91 | 14,442.27 | -15.4% |

Top 50 Co’s | $8,807 B | $9,836 B | -10.5% |

Mid 50 Co’s | $352 B | $506 B | -30.4% |

Bottom 50 Co’s | $140 B | $210 B | -33.2% |

Top Gainer — Super Micro (LSV #32) | $5,875 M | $1,963 M | 199.3% |

Top Loser — Shift | $19 M | $182 M | -89.6% |

All 35 Gainers | $2.26 T | $2.09 T | 8.1% |

All 115 Losers | $7.04 T | $8.46 T | -16.8% |

Note: Table reflects all 150 ranked companies year-over-year market cap changes. 138 companies from the 2022 rankings remain, and 12 are newly added to the list.

No slowdown in acquisition-based departures

As of this posting, ten Lonergan SV150 ranked public companies have been fully acquired and delisted since our ranking last year. These include:

- (2022 LSV#36) Twitter taken private by Elon Musk

- (2022 LSV#52) Zynga acquired by Two Interactive

- (2022 LSV#67) Poly acquired by HP Inc.

- (2022 LSV#72) Coherent merged with II-VI and moved to Pennsylvania

- (2022 LSV#79) Zendesk acquired by private equity consortium

- (2022 LSV#102) Coupa Software acquired by Thoma Bravo

- (2022 LSV#109) Anaplan acquired by Thoma Bravo

- (2022 LSV#116) Natus Medical acquired by Archimed

- (2022 LSV#139) Poshmark taken private

- (2022 LSV#142) NeoPhotonics acquired by Lumentum

As of the time of this analysis in April 2023, there are two additional LSV150 ranked companies in the process of being acquired/going private, including Broadcom’s intention to acquire LSV#23 VMware, and Francisco Partner’s bid to acquire LSV #141 Sumo Logic.

Note: the current pace of acquisitions is only slightly off from the previous twelve months. when there were twelve companies coming off the prior year’s ranking after being fully acquired.

2022: the year of no new tech IPOs

With the tech IPO market largely dormant in 2022, most of our newly ranked companies were drawn from public debuts which took place in 2021.

All 9 recently public companies added to this year’s rankings for the first time are shown below:

| Rank | Company (year public- IPO unless noted) | Business Description | 2022 Sales ($ million) | Growth | Profitability | Mkt Cap (March 31, 2023) |

|---|---|---|---|---|---|---|

106 | Lucid (2021 — SPAC) | EV automotive company | $608 | 2143% | -214% | $14.7 b |

128 | SentinelOne (2021) | Cybersecurity provider | $422 | 106% | -90% | $4.7 b |

133 | Doximity (2021) | Digital platform for medical professionals | $402 | 27% | 30% | $6.3 b |

135 | ACM Research (2021) | Wafer cleaning technology company | $389 | 50% | 10% | $0.7 b |

137 | Stem (2021) | Intelligent energy storage company | $363 | 185% | -34% | $0.9 b |

| 139 | Intapp (2021) | Cloud based software solutions | $309 | 27% | -29% | $2.9 b |

| 144 | JFrog (2021) | DevOps platform | $280 | 35% | -32% | $2.0 b |

| 148 | PubMatic (2020) | Cloud based advertising transactions | $256 | 13% | 11% | $0.7 b |

| 150 | Amplitude (2021 — DL) | Digital customer analysis | $238 | 42% | -39% | $1.5 b |

Rate of HQ departures slows way down

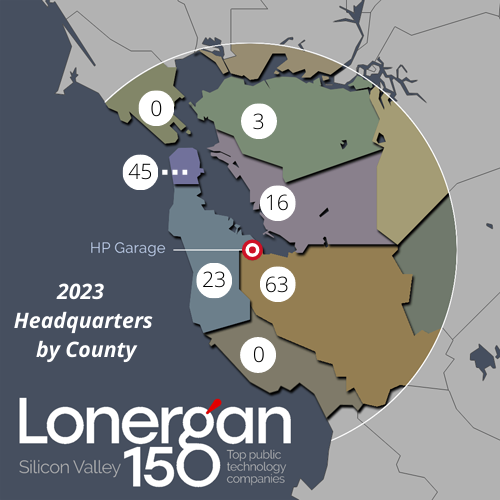

After 15 companies of the Lonergan SV150 moved headquarters out of Silicon Valley in 2020-2021, only one company from last year's rankings moved away in the past 12 months: LSV #45 Trimble, which moved to Westminster, Colorado.

Even as Silicon Valley sees a new trend in headquarters being moved out of the area, the actual concept of corporate headquarters may be changing. Joint Venture Silicon Valley notes in its 2023 Index that the Silicon Valley has embraced remote work at a higher rate than any other region of the US, with 35% of Silicon Valley workers operating from home (up from 9% in 2019). In a graphic illustration of this, LSV#20 Block even notes its location on its press releases as "Distributed Workforce Model/San Francisco."

Regardless of trends in the adoption of remote work, LSV150 companies still opt to identify their principal executive offices, and the Silicon Valley remains popular as the place to locate public tech company headquarters. In fact, 35 of the companies currently in the Lonergan SV150 are also constituent stocks of the S&P 500, which is a measure of the size and stability of the tech companies in Silicon Valley.

Lonergan SV150 headquarters still mostly in Santa Clara county

Santa Clara county is host to 63 of the LSV 150 headquarters, more than any other Bay Area county. Even without behemoth Apple (LSV#1) with its "spaceship" headquarters in Cupertino, the companies headquartered in Santa Clara represent 49% of our rankings' revenues and 47% of market cap.

Farther north, San Francisco is now home to 45 (30%) of Lonergan SV150 headquarters, which is a doubling since 2018. The companies headquartered in San Francisco represent 10% of revenues and 12% of market cap.

Alameda and Contra Costa counties have grown from hosting 15 HQs two years ago to 19 HQs today. San Mateo County also continues to grow, now with 23 HQs overall.

Geographic changes of note:

LSV #42 Autodesk, which last year was our lone company with a Marin county HQ, has moved its HQ to San Francisco.

Likewise, we lost our lone Santa Cruz county headquartered company, Poly (ranked #67 last year), to a 2022 acquisition.

See our map of Lonergan SV150 headquarters by county below: