Get the Company Rankings on a PDF suitable for printing

For detailed metrics on each company, download the LSV150 datatable

Read our People Insights

2021 is a surge year for just about everything

2021 set records for just about everything in the Lonergan Silicon Valley 150:

Revenues: up 25% from last year’s ranking, to $1.56 Trillion - a new high

Net income: up 42% from last year’s ranking, to $342 Billion - also a record high

Market cap: up 8% from March 31 of last year, to $10.6 Trillion, despite the headquarters moves of newly Texas-based Tesla, Oracle, and HPE, as well as the downward pressure on stocks from recent global economic and political events — this is a record high for the LSV150

On top of all this record shattering, there was a blockbuster crop of 17 newly public companies added to the rankings, as well as eight moving HQs out of the area, and twelve being acquired/going private.

Our rankings are dominated by Apple: #1 ranked Apple (representing 24% of Lonergan SV150 revenue) continued to be a major contributor to determining overall growth. Apple grew calendar year 2021 revenues by 29% versus only 10% for the 2020 calendar year (Apple fiscal year adjusted per our ranking methodology; the Apple fiscal year ended September 30, 2021).

Explosion of IPOs

In 2021, Silicon Valley companies continued to go public with enthusiasm, with the debut of such long awaited IPOs/direct listings such as Roblox (LSV#63) and Robinhood (LSV#66). This pace has slowed with recent economic and geopolitical uncertainty driving a long pause in public listings.

The highest ranking debut IPO on the Lonergan SV150 is LSV#53 ranked AppLovin, with 2021 revenues of $2.8 billion.

All 17 newly public companies added to this year’s rankings are shown below:

| Rank | Company (year public) IPO unless noted | Business Description | 2021 Sales ($ million) | Growth | Profitability | Mkt Cap (March 31, 2022) |

|---|---|---|---|---|---|---|

53 | AppLovin (2021) | Platform for mobile app developers | $2,793 | 92% | 1% | $20.7 b |

63 | Roblox (2021 direct listing) | Online game platform | $1,919 | 108% | -26% | $28.8 b |

66 | Robinhood (2021) | Financial services platform | $1,815 | 89% | -203% | $11.3 b |

75 | Informatica (2021) | Data management platforms | $1,444 | 9% | -7% | $5.5 b |

111 | Udemy (2021) | Platform for online learning | $518 | 21% | -15% | $1.7 b |

| 119 | Marqeta (2021) | Payments platform | $450 | 55% | -31% | $6.0 b |

| 122 | Samsara (2021) | Platform for IOT data collection | $428 | 71% | -83% | $8.0 b |

| 123 | Coursera (2021) | Online education services | $415 | 41% | -35% | $3.3 b |

| 126 | Confluent (2021) | Real-time cloud data platform | $388 | 64% | -88% | $11.2 b |

| 129 | NerdWallet (2021) | Platform for choosing financial products | $380 | 55% | -11% | $0.8 b |

| 132 | Freshworks (2021) | Customer and employee engagement platform | $371 | 49% | -52% | $5.1 b |

141 | HashiCorp (2021) | Software for cloud-building infrastructure | $384 | 67% | -47% | $9.9 b |

144 | Hims & Hers Health (2021 SPAC merger) | Telehealth platform for accessing health/wellness products | $272 | 83% | -40% | $1.1 b |

145 | GitLab (2021) | DevOps platform for improved software development | $253 | 66% | -61% | $8.0 b |

146 | thredUP (2021) | E‑Commerce platform for second hand apparel | $252 | 35% | -25% | $0.8 b |

148 | 23andMe (2021 SPAC merger) | Consumer genetics | $244 | 10% | -75% | $1.7 b |

149 | ChargePoint (2021 SPAC merger) | Provides EV charging networks | $242 | 65% | -55% | $6.7 b |

Increase in acquisition activity; pickup in companies going private

As of this posting, twelve Lonergan SV150 ranked public companies have been fully acquired and delisted since our ranking last year. These include:

- (2021 LSV#42) Varian Medical acquired by Siemans

- (2021 LSV#43) Xilinx acquired by AMD

- (2021 LSV#45) McAfee taken private

- (2021 LSV#54) Maxim acquired by Analog Devices

- (2021 LSV#79) Proofpoint acquired by Thoma Bravo

- (2021 LSV#82) FireEye, whose product business was acquired by Symphony Technology Group and is now spun-off as Trellix

- (2021 LSV#86) Slack acquired by Salesforce.com

- (2021 LSV#92) Cloudera taken private

- (2021 LSV#100) Inphi acquired by Marvell

- (2021 LSV#119) Glu Mobile acquired by EA

- (2021 LSV#115) Medallia acquired by Thoma Bravo

- (2021 LSV #146) Vocera acquired by Stryker.

As of the time of this analysis in April 2022, there are a few additional LSV150 ranked companies in the process of being acquired/going private, including HP Inc.‘s intention to acquire LSV#67 Poly; II-VI’s plan to acquire LSV#72 Coherent; and Thoma Bravo’s plan to acquire LSV#109 Anaplan. Cisco (LSV#6) made a February 2022 offer for LSV#55 Splunk, but this deal does not seem to be moving forward.

Some believe the FTC’s successfully blocking NVIDIA’s acquisition of Arm in early 2022 may be evidence of a slowdown in large tech deals going forward.

Note: there were only five companies coming off the prior year’s ranking after being fully acquired in the subsequent twelve months. These were Fitbit (2020 LSV#60), Forescout (2020 LSV#123), Telenav (2020 LSV#139), Mobileiron (2020 LSV#144), and Livongo Health (2020 LSV#149).

Leaving the Silicon Valley was popular for the second year in a row

Eight companies on last year’s 2021 Lonergan SV150 ranking moved headquarters out of the Silicon Valley, with all but one moving out of state. Together these companies represented $68 billion in revenue (mostly from Tesla) and $1.3 trillion in March 31, 2022 market cap.

Which eight companies from the rankings from last year have moved?

| Last Year’s Rank | Company (New headquarters) | 2021 Revenues ($ million adjusted to quarter closest to calendar year end) | Market cap (March 31, 2022) |

|---|---|---|---|

| 7 | Tesla (Austin, TX) | $53,823 | $1,114 b |

50 | Opendoor (Tempe, AZ) | $8,021 | $5.4 b |

70 | FICO (Bozeman, Montana) | $1,326 | $12.3 b |

85 | Extreme (North Carolina) | $1,080 | $1.6 b |

90 | Crowdstrike (Austin, TX) | $1,452 | $52.4 b |

| 104 | Snowflake (Bozeman, Montana) | $1,219 | $70.2 b |

| 117 | Quotient (Salt Lake City) | $521 | $606 m |

| 129 | Arlo Technologies (Carlsbad, CA) | $435 | $751 m |

The seven companies from the year prior’s movers list were: Oracle, HPE, Avaya, Align, VIAVI, Natera, and Aviat, bringing the total number of HQ movers to 15 in two years.

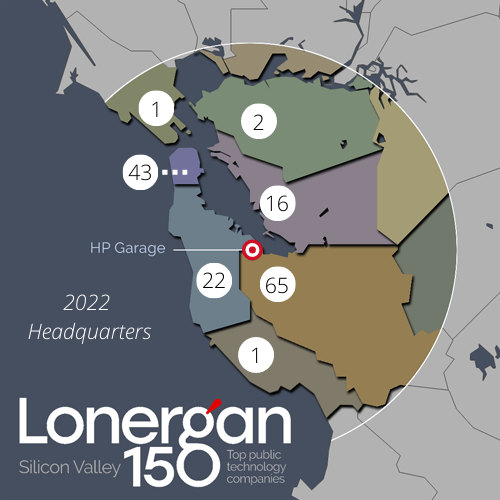

Lonergan SV150 headquarters dispersing across the Bay Area

The historic home for the Silicon Valley in the old orchard country of the South Bay remains the center of gravity for the headquarters of the LSV 150. Santa Clara County hosts 65 of the LSV 150 headquarters, and even without behemoth Apple (LSV#1) with its “spaceship” headquarters in Cupertino, the companies headquartered in Santa Clara represent 50% of our rankings’ revenues and market cap.

Farther north, San Francisco is now home to 43 (29%) of Lonergan SV150 headquarters, which is a doubling since 2018. The companies headquartered in San Francisco represent 9% of revenues and 13% of market cap.

For the first time, counties other than San Francisco are showing growing HQ appeal; the fastest growing county for HQs was Alameda, which grew 20% from 13 HQs to 16 HQs. San Mateo County also continues to grow, with 22 HQs overall.

As for the newest companies on the rankings, there is some gratifying diversity in the locations chosen for their HQs:

- 6 of the 17 newly public companies debuting on the list are headquartered in San Francisco

- 2 of the 17 newly public companies are in Oakland (Marqeta (LSV#119) and thredUP (LSV#146)) which is in Alameda County

- Of the remaining 9 newly public companies, 5 are in San Mateo County and 4 are in Santa Clara County